Analysis: The top pharmacies for BP checks – and why the DH isn't happy

In Analysis

Follow this topic

Bookmark

Record learning outcomes

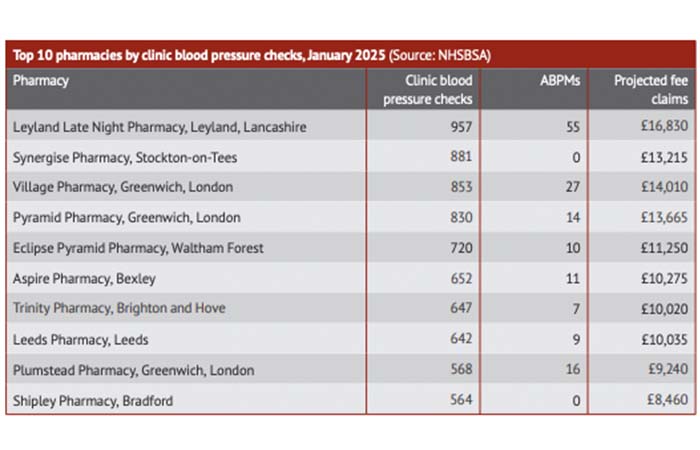

In January, the top performing pharmacy for clinic blood pressure checks claimed nearly £17,000 for hypertension consultations – but achieved an ABPM conversion rate of under 6 per cent. P3pharmacy explores the reasons for governmental discontent

Health policymakers have indicated they are unhappy with how pharmacies are delivering the hypertension case-finding service in England.

While the number of clinic blood pressure checks is in the hundreds of thousands each month – reaching a recent peak of 334,000 in October 2024 – far fewer patients go on to receive ambulatory blood pressure monitoring (ABPM) than the Department of Health and Social Care (DHSC) would like.

Granted, monthly data releases from the NHS Business Services Authority suggest the rate of patients being converted to ABPM after an initial clinic blood pressure check is climbing.

In January this year there were 228,096 clinic checks and 22,215 ABPMs, a ratio of roughly 10:1. Compare that to April 2024, when there were 217,420 checks and 15,995 ABPMs.

But it is still far fewer than the DHSC believes there should be, based on what we know about the prevalence of hypertension in England, Community Pharmacy England’s NHS services director Alastair Buxton told the Sigma Pharmaceuticals conference in May.

Out of the hundreds of thousands of patients offered a pharmacy hypertension check “we’ve got 30 per cent of patients who require ABPM and we’re getting absolutely nowhere near that number,” Buxton said via videolink.

He added: “These are people with potential hypertension that need treating.”

How has the government expressed its dissatisfaction? Through threats around funding, unsurprisingly enough.

From October, under the new contractual arrangements pharmacies will have to achieve at least one ABPM provision per month to qualify for the monthly activity payment of £500 or £1,000 (depending on their Pharmacy First numbers) as service ‘bundling’ kicks in.

The incentives are also changing. As of 1 April, clinic checks command a fee of £10 (down from £15) and ABPMs a fee of £50.85 (up from £45).

This is to reflect the fact that all appropriately trained staff members can now deliver the service.

One ABPM per month may not sound too onerous – but just 4,314 pharmacies managed to achieve that in January. The average per pharmacy was two, but this will be skewed by the outliers.

Incidentally, the same is probably true of clinic checks, for which the average was 43 per pharmacy.

That figure of 4,314 – less than a half of pharmacies in England – suggests a major step change will be needed to counteract a trend that has persisted since the service first launched in 2021.

Buxton was sceptical as to whether the NHS will show any flexibility around this target should pharmacies fail to hit it, as it previously did when it delayed increasing the number of Pharmacy First gateway consultations contractors had to achieve each month.

“We’ll see what happens on that,” he told P3pharmacy when that question was put to him, adding: “We need to tackle this ourselves within the sector. The level of ABPM conversion from clinic checks is too low.”

Who are the top-performing pharmacies?

So, who are the current top performers with the hypertension case-finding service, and how good are they at converting clinic checks to ABPMs?

In answer to the second question, pretty poor on the whole. None of the top claimers in our top 10 table (ranked by the number of clinic checks carried out) achieved anything like the 30 per cent conversion rate Buxton suggested pharmacies should all be aiming for.

In the first spot was Leyland Late Night Pharmacy, which at 55 ABPMs (worth £2,475) versus 957 clinic checks (£14,355) had a conversion rate of just under 6 per cent.

The second highest performer, Synergise Pharmacy in Stockton-On-Tees, clocked no ABPMs in January, as did Bradford’s Shipley Pharmacy in 10th place.

None of the biggest claimers for the service feature in the top 10 for ABPMs – which ranges from 58 to 82 recorded claims – although Leyland Late Night Pharmacy wasn’t too far off it.

This isn’t necessarily cause for blame. There are, of course, those patients whose readings are so high that pharmacy teams are obliged to escalate the case immediately.

And patient aversion may be a factor too, with Buxton commenting that a number of patients just don’t fancy the idea of lugging a device around all day.

He said that as an alternative to the “NICE gold standard” of providing 24-hour ABPM to patients with high in-clinic readings, the NHS is exploring whether patients could instead be loaned a BP meter to take readings over the course of a week. “This is something we’ve wanted from the start of the service,” he said.

Interestingly, the top 10 table suggests that being based in South East London – specifically Greenwich – doesn’t hurt your chances of hitting high numbers with the service, with three pharmacies in that locality featuring in our top 10.

Is this to do with engaged teams, good relationships with local GPs or some other factor? We hope to delve into these geographical trends in future articles.

Also notable is the fact that Rimmington Pharmacy in Bradford did not make any hypertension claims at all in January.

This pharmacy has by far the highest number of total claims since the service first launched in 2021 at 54,954, just over triple the figure of 17,380 achieved by Hayshine Ltd in Welling, its nearest competitor.

And despite reports of supermarket chains imposing hypertension service targets on their staff – P3pharmacy has in recent months exposed stories concerning Asda and Tesco – all of the top achievers are either small independents or local chains.